Postal Explorer >

IMM Issue 36 - International Mail Manual >

1 International Mail Services > 120 Preparation for Mailing > 123 Customs Forms and Online Shipping Labels

Only two customs declaration forms are used, as required under 123.6, for international mail: PS Form 2976, Customs Declaration CN 22 — Sender’s Declaration (green label); and PS Form 2976–A, Customs Declaration and Dispatch Note — CP 72. PS Form 2976–E, Customs Declaration Envelope — CP 91, is used as a carriage document for PS Form 2976–A.

Note: The current edition of PS Form 2976 is January 2004; the current edition of PS Form 2976-A is May 2009; the current edition of PS Form 2976-E is September 2006. Except as provided in 123.3 and 123.8, mailers must present at the time of mailing a fully completed sender’s declaration (the Post Office™ copy of PS Form 2976 or 2976-A), which specifies both the sender’s name and address and the addressee’s name and address.

Customs declaration forms are available without charge at Post Office facilities. Upon request, mailers may receive a reasonable supply for mail preparation. Customers may also order supplies of the customs forms from The Postal Store at http://shop.usps.com; search on the words “customs forms.” Customs declaration forms are also available through an online customs form application at usps.com/webtools.

If authorized, mailers may privately print PS Forms 2976 and 2976–A. Privately printed forms must be identical in size, design, and color to the Postal Service™ forms, and each form must contain a unique Code U 128 barcode symbology that can be read by Postal Service equipment. Mailers may obtain form specifications from the following address:

BARCODE CERTIFICATION

NATIONAL CUSTOMER SUPPORT CENTER

UNITED STATES POSTAL SERVICE

6060 PRIMACY PKWY STE 201

MEMPHIS TN 38188–0001

Mailers can also obtain form specifications by calling the NCSC at 800–238–3150 — select option 5 for barcode certification — or online at http://ribbs.usps.gov/files/IntCustomsForms; click on customstechguide.pdf.

Upon receipt of the request, the NCSC will send mailers an application and specifications for preparing PS Forms 2976 and/or 2976–A. The application clearly explains the process necessary for authorization. When authorized by the NCSC, a mailer may omit printing the Post Office copy (copy 5) of PS Forms 2976 and/or 2976–A by submitting an authorized manifest listing of the items. The manifest must be typewritten, legibly handwritten, or computer–generated, and must contain the following information:

- The sender’s name and address.

- The sender’s print authorization number (i.e., barcode).

- The edition date of the privately printed form.

- The same certification statement that is printed on the Postal Service form.

- A list of the foreign recipients’ names and delivery addresses.

- The mailer’s signature and date.

Certain items must bear one or more of the forms required by the nonpostal export regulations described in chapter 5.

A commercial invoice is a bill for goods from the seller to the buyer. A commercial invoice must be completed where required and must contain the following basic information:

- Seller’s complete contact information.

- Receiver’s complete contact information.

- Consignee’s complete contact information (if it is different from the buyer’s).

- Country of origin.

- Destination country.

- Reason for export.

- Total commercial value of the item(s) shipped.

- Sales and payment terms (if any).

- Currency of sale.

- Full quantities and description of the merchandise.

- A statement certifying that the invoice is correct.

Except as specified below, a mailer may not deposit a postal item that requires a completed customs declaration form into a street collection box or a Post Office lobby drop. Mailers must tender such items to a Postal Service employee at a Post Office facility or other location as designated by the postmaster. Otherwise, the Postal Service will return them to the sender for proper entry and acceptance.

Exception: The above restriction on the deposit of customs mail does not apply to Express Mail International® shipments paid through an Express Mail corporate account (EMCA). Mailers may deposit such items into a designated Express Mail® collection box or Post Office lobby drop.

As shown in Exhibit 123.61, mailers must use PS Form 2976 or 2976–A (PS Form 2976-A must be accompanied by PS Form 2976-E).

Exhibit 123.61

Customs Declaration Form Usage by Mail Category

Type of Item

|

Declared Value

|

Required Form

|

Comment

|

Global Express Guaranteed

|

All items

|

All values

|

Mailing label (item 11FGG1)

|

|

Express Mail International

|

All items

|

All values

|

2976 or 2976-A

|

Required Customs Forms and endorsements vary by country and are specified in the Individual Country Listings.

|

Priority Mail International

|

All items

|

All values

|

2976-A

|

All items mailed in USPS-produced Priority Mail International packaging and any item bearing a Priority Mail sticker or marked with the words “Priority Mail” are considered parcels, except the Priority Mail International flat-rate envelope and small flat-rate box. Do not use PS Form 2976 (green label) on Priority Mail International parcels.

|

Priority Mail International Flat-Rate Envelope and Small Flat-Rate Box (maximum weight limit: 4 pounds)

|

All items except the known mailer exemption described in the entry below.

|

Under $400

|

29761

|

May contain personal correspondence including letters, documents, printed matter, and light-weight merchandise items. Merchandise is permitted unless prohibited by the destination country.

|

$400 and over

|

2976-A1

|

Items that weigh 16 ounces or more, do not have potentially dutiable contents, and are entered by a known mailer

|

N/A

|

None

|

A known mailer, as defined in 123.62, may be exempt from affixing customs forms to nondutiable mailpieces that weigh 16 ounces or more.

|

First-Class Mail International (maximum weight limit: 4 pounds)

|

Regardless of weight, items that have potentially dutiable contents

|

Under $400

|

29761

|

|

$400 and over

|

2976-A1

|

Items that weigh less than 16 ounces and do not have potentially dutiable contents

|

N/A

|

None

|

|

Items that weigh 16 ounces or more and do not have potentially dutiable contents

|

N/A

|

29761

|

|

Items that weigh 16 ounces or more, do not have potentially dutiable contents, and are entered by a known mailer

|

N/A

|

None

|

A known mailer, as defined in 123.62, may be exempt from affixing customs forms to nondutiable mailpieces that weigh 16 ounces or more.

|

Free Matter for the Blind2

|

All items

|

Under $400

$400 and over

|

29761

2976-A1

|

|

M-bag3

|

All items

|

Under $400

$400 and over

|

29761

2976-A1

|

|

1 Placement of forms: Use PS Form 2976 (green label) for a Priority Mail International flat-rate envelope and small flat-rate box and a First-Class Mail International item under $400 in value; affix the form to the address side of the package. If the value of the contents is $400 or more, affix the upper portion of PS Form 2976 (green label) (cut on dotted line and discard the lower portion) to the outside of the package, complete a separate PS Form 2976-A, and enclose the form set inside the package.

2 Free matter for the blind requires a customs form for all articles.

3 An M-bag requires a customs form when it contains potentially dutiable printed matter, and admissible merchandise items as defined in 261.22 or some combination thereof.

Note: Bulk business products, including International Surface Air Lift (ISAL) and International Priority Airmail (IPA), require customs forms based on package contents and weight as specified above and as required by the country of destination.

|

A “known mailer” is defined as:

- A business customer who tenders volume mailings through a business mail entry unit (BMEU) or other bulk mail acceptance location, completes a postage statement at the time of entry, pays postage through an advance deposit account, and uses a permit imprint as an indication of postage payment. International Surface Air Lift (ISAL) and International Priority Airmail (IPA) customers are considered to be “known mailers” for this purpose.

- A federal, state, or local government agency whose mail is regarded as Official Mail.

- A contractor who sends out prepaid mail on behalf of a military service, provided the mail is endorsed “Contents for Official Use — Exempt from Customs Requirements.”

Note: “Known mailers” are exempt from the customs form requirement that would otherwise apply to mailpieces weighing 16 ounces or more provided that the following conditions of entry are met:

- The mailpieces contain no merchandise items or other contents that are potentially dutiable.

- The mailer pays postage through an advance deposit account and accounts for the postage on the required postage statement.

Exception: Mailpieces that are paid for by postage meter do not qualify for the “known mailer” exemption. The exemption applies only to International Surface Air Lift (ISAL) and International Priority Airmail (IPA) mailpieces that are paid with a combination postage method (meter postage affixed to the piece and additional postage by permit imprint). Such mailpieces must bear the ISAL/IPA service endorsements prescribed in 292.42 and 293.42, respectively.

- The mailer certifies on the postage statement that the mailpieces contain no dangerous materials that are prohibited by postal regulations.

- The import regulations of the destination country allow individual mailpieces without a customs form affixed.

When the chief postal inspector determines that a unique, credible threat exists, the Postal Service may require a mailer to provide photo identification at the time of mailing. The signature on the identification must match the signature on the customs declaration form.

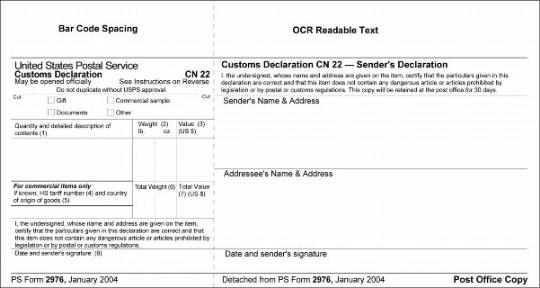

A sender must complete PS Form 2976, Customs Declaration CN 22 — Sender’s Declaration (green label). See Exhibit 123.711 for a copy of PS Form 2976.

- Check the appropriate box to indicate whether the package contains a gift, documents, commercial samples, or other items.

- In block (1), provide a detailed description, in English, of each article and the quantity for each article. General descriptions such as “food,” “medicine,” “gifts,” or “clothing” are not acceptable. In addition to the English text, a translation in another language is permitted.

- In block (2), give the weight of each article in pounds and ounces,

if known.

- In block (3), declare the value of each article in U.S. dollars.

Note: The sender may declare that the contents have no value. However, declaring that the contents have no value does not exempt an item from customs examination or charges in the destination country.

- The sender must enter the actual value of an item for registered items in a consistent manner on PS Forms 3806 and 2976 — i.e., the value entered must be identical. Items on which identical values are not declared will be refused. (See 334.12.)

- In blocks (4) and (5) — which are only for commercial items (i.e., any goods exported/imported in the course of a business transaction, whether or not they are sold for money or exchanged) — enter, if known, the HS tariff number (6 digits), which must be based on the Harmonized Commodity Description and Coding System developed by the World Customs Organization, and the country of origin, which is the country where the goods originated (i.e., where they were produced, manufactured, or assembled).

- In block (6), give the total weight of the item, if known.

- In block (7), give the total value of the item in U.S. dollars.

- In block (8), sign and date in the blocks indicated on the left side and the right side of the form. The sender’s signature certifies that all entries are correct and that the item contains no dangerous article prohibited by postal or customs regulations

- Enter the sender’s full name and address and the addressee’s full name and address in the blocks indicated.

- Affix the form to the address side of the item and present the item for mailing.

Exhibit 123.711

PS Form 2976, Customs Declaration CN 22 — Sender’s Declaration (green label)

The Postal Service acceptance employee must do the following when accepting PS Form 2976 from the sender:

- Instruct the sender how to complete, legibly and accurately, PS Form 2976, as required. The sender’s failure to complete the form properly can delay delivery of the item or inconvenience the sender and addressee. Moreover, a false, misleading, or incomplete declaration can result in the seizure or return of the item and/or in criminal or civil penalties. The Postal Service assumes no responsibility for the accuracy of information that the sender enters on PS Form 2976.

- Verify that the sender has entered the information on the form, and has signed and dated the form in the spaces provided on the left side and the right side of the form. The sender’s address on the mailpiece must match the sender’s address on PS Form 2976.

- Enter the total weight of the package on the form, if the sender has not already done so.

- Round stamp the right side of the form (the Post Office copy) and tell the sender that the Postal Service will retain this document for 30 days as a record of mailing.

Note: To comply with international mail aviation security procedures, the Postal Service employee must endorse any item weighing 16 ounces or more that is not accepted by an authorized employee, or that is subject to uncertain acceptance conditions (e.g., if received through a collection box or left on an unattended dock), with a “customer notification DDD–2” sticker and “surface only” and return the item to the sender by surface transportation. Consult the most recent international aviation security procedures for comprehensive acceptance procedures.

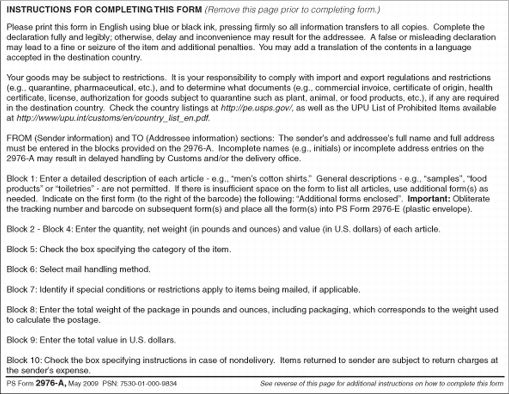

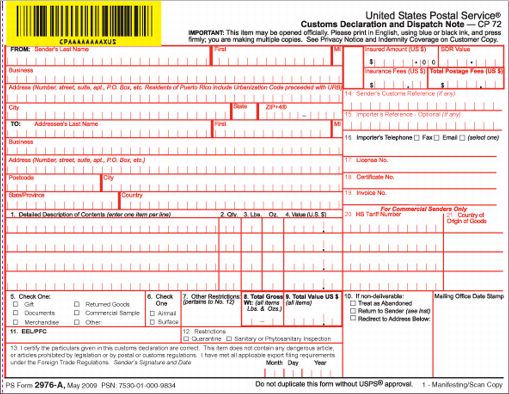

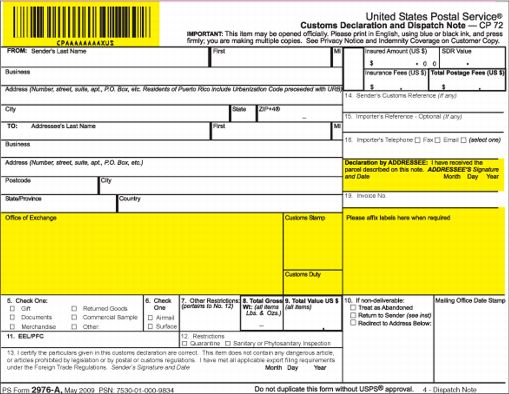

123.72 PS Form 2976–A, Customs Declaration and Dispatch Note — CP 72

- Enter the sender’s full name and address and the addressee’s full name and address in the blocks indicated.

- Enter information for customs reference, importer’s reference, and telephone/fax/e-mail, if known.

- In block (1), provide a detailed description, in English, of each article. General descriptions such as “food,” “medicine,” “gifts,” or “clothing” are not acceptable. In addition to the English text, a translation in another language is permitted. If there is insufficient space on the form to list all contents, use a second form (and subsequent forms, if necessary) to continue listing the contents and indicate on the first form that the contents are continued on a subsequent form(s). When using this option, customers must ensure that the barcodes on the subsequent forms are totally obliterated to avoid multiple barcodes being assigned to the package. Place the form(s) into PS Form 2976–E (plastic envelope).

- In block (2), enter the quantity of each article.

- In block (3), enter the net weight of each article in pounds and ounces, if known.

- In block (4), enter the value for each article in U.S. dollars.

- In block (5), check the appropriate box to indicate whether the package contains a gift, documents, commercial samples, or other items.

- In block (6), check the appropriate box for the applicable type of service.

- In block (7), note any restrictions that pertain to block 12.

- In block (8), enter the total gross weight in pounds and ounces.

- In block (9), enter the total value of all items in U.S. dollars.

- In block (10), provide disposal instructions in the event that the package cannot be delivered. Check the appropriate box to indicate whether the package is to be returned, treated as abandoned, or forwarded to an alternate address. Undeliverable packages returned to the sender are, upon delivery, subject to collection of return postage and any other charges assessed by the foreign postal authorities. If you are unwilling to pay return postage, check the box “Treat as Abandoned.”

- In block (11), enter the applicable Exemption or Exclusion Legend, Proof of Filing Citation, or AES Downtime Citation.

- In block (12), provide details if the contents are subject to quarantine (plant, food products, etc.).

- In block (13), sign and date the form. The sender’s signature certifies that all entries are correct and that the item contains no dangerous article prohibited by postal or other regulations.

- In blocks (14), (15), (16), (17), (18), and (19), enter the applicable number if the item requires a sender’s customs reference or importer’s reference, or if the item is accompanied by a license, certificate, or invoice.

- In blocks (20) and (21) — which are for commercial items only (i.e., goods exported/imported in the course of a business transaction whether or not they are sold for money or exchanged) — enter, if known, the HS tariff number (which is the six-digit number based on the Harmonized Commodity Description and Coding System developed by the World Customs Organization) and the country of origin (which is the country where the goods originated — i.e., where the goods were produced, manufactured, or assembled).

- Affix PS Form 2976-A according to the class of mail, as follows:

- For a Priority Mail International parcel, with the exception of the flat-rate envelope and small flat-rate box, allow the Postal Service employee to complete PS Form 2976-A as described in 123.722, place the form set inside PS Form 2976–E (plastic envelope), and affix it to the address side of the package.

- For a Priority Mail International flat-rate envelope or small flat-rate box or a First-Class Mail International item valued at $400 or more, or if you do not want to list the contents on the outside wrapper, affix the upper portion only of PS Form 2976 (green label) (cut on the dotted line and discard the lower portion) to the address side of the package, complete PS Form 2976-A, and enclose the form set inside the package.

- Present the item for mailing.

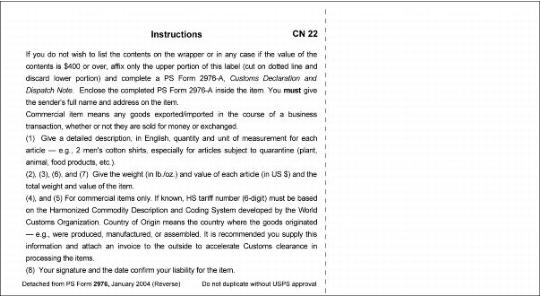

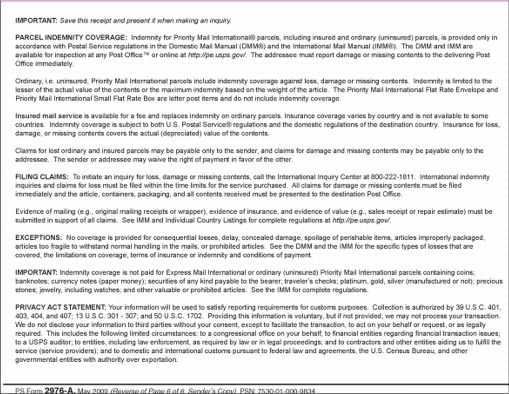

Exhibit 123.721

PS Form 2976-A, Customs Declaration and Dispatch Note — CP 72

(Instructions, Copies 1 and 4, and Indemnity Statement)

Note: To see the complete PS Form 2976-A, click the link below:

http://www.usps.com/forms/_pdf/ps2976a.pdf

Exhibit 123.721 (continued)

PS Form 2976-A, Customs Declaration and Dispatch Note — CP 72

(Instructions, Copies 1 and 4, and Indemnity Statement)

Exhibit 123.721 (continued)

PS Form 2976-A, Customs Declaration and Dispatch Note — CP 72

(Instructions, Copies 1 and 4, and Indemnity Statement)

The Postal Service acceptance employee must do the following when accepting PS Form 2976–A from the sender:

- Instruct the sender how to complete, legibly and accurately, PS Form 2976–A, as required. The sender’s failure to complete the form properly can delay delivery of the item or inconvenience the sender and addressee. Moreover, a false, misleading, or incomplete declaration can result in the seizure or return of the item and/or in criminal or civil penalties. The Postal Service assumes no responsibility for the accuracy of information that the sender enters on PS Form 2976–A.

- Verify that the sender has entered the information on the form and has signed and dated the declaration. The sender’s address on the mailpiece must match the sender’s address on PS Form 2976–A.

- If the sender wishes to insure the contents, the retail associate will record the insured amount in U.S. dollars and SDR value on PS Form 2976-A in the space provided. (See Exhibit 324.12 (p. 1) for conversion to SDRs.)

- Weigh the parcel, enter the weight in block (8), and enter the applicable amount of postage and fees in the appropriate block in the upper right corner of the form.

- Round stamp the form in the appropriate place on each copy (copies 1–6).

- Remove the Post Office copy (copy 5) and tell the mailer that the Postal Service will retain this document for 30 days as a record of mailing. Remove the Mailer copy (copy 6) and give it to the mailer.

- Round stamp any uncanceled stamps, and if postage is paid by meter, round stamp the front of the piece near the meter postage.

Note: To comply with international mail aviation security procedures, the Postal Service employee must endorse any item weighing 16 ounces or more that is not accepted by an authorized employee, or that is subject to uncertain acceptance conditions (e.g., if received through a collection box or left on an unattended dock), with a “customer notification DDD–2” sticker and “surface only” and return the item to the sender by surface transportation. Consult the most recent international aviation security procedures for comprehensive acceptance procedures.

123.73 PS Form 2976–E, Customs Declaration Envelope — CP 91

PS Form 2976–E is a transparent plastic envelope designed to carry and protect the PS Form 2976–A form set. After completing the forms, the sender inserts the PS Form 2976–A form set into the envelope of PS Form 2976–E, removes the backing sheet, and affixes it to the package on the address side.

Express Mail International and Priority Mail International items that have been prepared and paid online through Click-N-Ship on usps.com, through the eBay/PayPal integrated shipping solution, or through an authorized PC Postage vendor web site contain all necessary mailing label and customs form information. Customers must hand the item to a Postal Service employee in a Post Office, hand the item to their carrier at the time of mail delivery, or schedule pickup service (see 222.23 or 234.6).

|