Postal Explorer >

- International Mail Manual >

1 International Mail Services > 120 Preparation for Mailing > 123 Customs Forms and Online Shipping Labels

As required under 123.6, only three customs declaration forms are used for international mail:

- PS Form 2976, Customs Declaration CN 22 — Sender’s Declaration.

- PS Form 2976-A, Customs Declaration and Dispatch Note — CP 72.

- PS Form 2976-B, Priority Mail Express International Shipping Label and Customs Form (used only for Priority Mail Express International items).

PS Form 2976-E, Customs Declaration Envelope — CP 91, is a plastic envelope that is used to carry and protect the PS Form 2976-A and PS Form 2976-B customs form sets (see 123.73).

The current edition of PS Form 2976 is July 2013; the current edition of PS Form 2976-A is July 2013; and the current (and only) edition of PS Form 2976-B is July 2013.

For PS Form 2976 and PS Form 2976-A, the only other authorized edition is September 2012.

Customs declaration forms are available without charge at Post Office facilities. Upon request, mailers may receive a reasonable supply for mail preparation. Customers may also order supplies of the customs forms from The Postal Store at http://shop.usps.com; search on the words “customs forms.” Customs declaration forms are also available through an online customs form application at usps.com/webtools.

A mailer may not use privately printed customs forms without written authorization. If authorized, a mailer may privately print PS Forms 2976 and 2976-A as specified in the Customs Form Certification Checklist, which is available by clicking on the link to that checklist at the Web site noted in 123.31b. In addition, each form must contain a unique barcode that can be read by Postal Service equipment. A mailer may obtain customs form and barcode specifications through the following methods:

- By calling the NCSC at 877-264-9693 (select option 3 for barcode certification).

- By visiting https://ribbs-dev.usps.gov/index.cfm?page=intcustomsforms.

- By written request to the following address:

Delivery Confirmation

NATIONAL CUSTOMER SUPPORT CENTER

UNITED STATES POSTAL SERVICE

225 N Humphreys BLVD STE 501

MEMPHIS TN 38188-1001

Upon receipt of the request, the NCSC will send the mailer an application and specifications for preparing PS Forms 2976 and/or 2976-A.

For an item bearing a privately printed customs form under 123.31, a mailer must electronically transmit customs declaration information by using USPS-produced Global Shipping Software (GSS) or other USPS-approved software. Failure to provide electronically transmitted customs declaration information before tendering the mailing may result in refusal at acceptance, delay in processing, and/or return of mail to the sender.

Specific options for electronically transmitting customs declaration information and additional information may be found in the Customs Form Certification Checklist, which is available by clicking on link to that checklist at the web site noted in 123.31b.

Certain items must bear one or more of the forms required by the nonpostal export regulations described in chapter 5.

A commercial invoice is a bill for goods from the seller to the buyer. A commercial invoice must be completed where required and must contain the following basic information:

- Seller’s complete contact information.

- Receiver’s complete contact information.

- Consignee’s complete contact information (if it is different from the buyer’s).

- Country of origin.

- Destination country.

- Reason for export.

- Total commercial value of the item(s) shipped.

- Sales and payment terms (if any).

- Currency of sale.

- Full quantities and description of the merchandise.

- A statement certifying that the invoice is correct.

Mailpieces bearing customs declarations have specific deposit requirements based on mail category, shape, and weight. Refer to the specific IMM part below for determination:

- Global Express Guaranteed mailpieces — see 215.

- Priority Mail Express International mailpieces — see 225.

- Priority Mail International mailpieces — see 235.

- First-Class Mail International mailpieces — see 245.

- First-Class Package International Service mailpieces — see 255.

The following conditions apply to customs forms for international mail items:

- Except as provided in 123.62, mailers must use PS Form 2976, PS Form 2976-A, or PS Form 2976-B as described in Exhibit 123.61.

- The surface area of the address side of the item to be mailed must be large enough to contain completely the applicable customs form, postage, and any applicable markings, endorsements, and extra service labels.

- Regardless of any listing in Exhibit 123.61, items containing articles that require an export license (see 532) must always bear PS Form 2976-A or PS Form 2976-B — note that PS Form 2976-B is used only for Priority Mail Express International items. In certain circumstances, this might require the mailer to send the mailpiece via Priority Mail Express International service or Priority Mail International service (but not with Priority Mail International Flat Rate Envelopes or Small Flat Rate Priced Boxes).

Exhibit 123.61

Customs Declaration Form Usage by Mail Category

Type of Item

|

Declared Value, Weight, or Physical Characteristic

|

Required PS Form

|

Comment (if applicable)

|

Global Express Guaranteed Items

|

All items.

|

All values

|

6182

|

PS Form 6182, Commercial Invoice, is required for certain commodities and destinations. For determination, see Publication 141, Global Express Guaranteed Service Guide.

|

Priority Mail Express International Items

|

All items.

|

All values

|

2976, 2976-A, or 2976-B

|

Required customs forms and endorsements vary by country and are specified in the Individual Country Listings.

|

Priority Mail International Items Except Flat Rate Envelopes and Small Flat Rate Priced Boxes

|

All Priority Mail International items except Flat Rate Envelopes and Small Flat Rate Priced Boxes.

|

All values

|

2976-A

|

Except for Priority Mail International Flat Rate Envelopes and Small Flat Rate Priced Boxes, all items mailed in USPS-produced Priority Mail International packaging or any other container bearing a Priority Mail sticker or marked with the words “Priority Mail” are considered to be within the scope of this requirement.

|

Priority Mail International Flat Rate Envelopes (Maximum weight limit: 4 pounds)

|

All Priority Mail International Flat Rate Envelopes containing only documents except for the known mailer exemption described in the entry below.

|

Under 16 ounces, no more than 3/4 inch thick, and uniformly thick

|

None*

|

See 123.63 for additional information concerning “documents.”

|

16 ounces or more, more than 3/4 inch thick, or not uniformly thick

|

2976

|

All Priority Mail International Flat Rate Envelopes that are entered by a known mailer as defined in 123.62 and items that qualify under 123.62.

|

Must not exceed $400

|

None

|

Not applicable.

|

All Priority Mail International Flat Rate Envelopes containing any goods, regardless of weight.

|

$400 or less

|

2976

|

Merchandise is permitted unless prohibited by the destination country.

|

Over $400

|

Prohibited

|

Items over $400 must be mailed using Global Express Guaranteed service, Priority Mail Express International service, or Priority Mail International service (other than Flat Rate Envelopes or Small Flat Rate Priced Boxes).

|

Priority Mail International Small Flat Rate Priced Boxes (Maximum weight limit: 4 pounds)

|

All Priority Mail International Small Flat Rate Priced Boxes, regardless of contents.

|

$400 or less

|

2976

|

Merchandise is permitted unless prohibited by the destination country.

|

Over $400

|

Prohibited

|

Items over $400 must be mailed using Global Express Guaranteed service, Priority Mail Express International service, or Priority Mail International service (other than Flat Rate Envelopes or Small Flat Rate Priced Boxes.

|

First-Class Mail International Letters and Large Envelopes (Flats), Including International Priority Airmail (IPA) Items and International Surface Air Lift (ISAL) Items (Maximum weight limit: 4 pounds)

|

All letter-size and flat-size items, as defined in 241.2, containing only documents except for the known mailer exemption described in the entry below.

|

Under 16 ounces

|

None*

|

See 123.63 for additional information concerning “documents.”

|

16 ounces or more

|

2976

|

All letter-size and flat-size items, as defined in 241.2, that are entered by a known mailer as defined in 123.62 and items that qualify under 123.63.

|

Must not exceed $400

|

None

|

Not applicable.

|

All items containing any goods, regardless of weight.

|

$400 or less

|

2976

|

Merchandise is permitted unless prohibited by the destination country.

|

Over $400

|

Prohibited

|

Items over $400 must be mailed using Global Express Guaranteed service, Priority Mail Express International service, or Priority Mail International service (other than Flat Rate Envelopes or Small Flat Rate Priced Boxes).

|

First-Class Package International Service Packages (Small Packets), Including IPA Items and ISAL Items

(Maximum weight limit: 4 pounds)

|

All First-Class Package International Service packages (small packets), as defined in 251.2, regardless of contents.

|

$400 or less

|

2976

|

Merchandise is permitted unless prohibited by the destination country.

|

Over $400

|

Prohibited

|

Items over $400 must be mailed using Global Express Guaranteed service, Priority Mail Express International service, or Priority Mail International service (other than Flat Rate Envelopes or Small Flat Rate Priced Boxes).

|

All package-size items, as defined in 251.2, that are entered by a known mailer as defined in 123.62 and items that qualify under 123.63.

|

Must not exceed $400

|

None

|

Not applicable.

|

Free Matter for the Blind

|

All items.

|

Follow above requirements for relevant mail category, as appropriate.

|

Follow above requirements for relevant mail category, as appropriate.

|

See 270 for authorized mail classes and eligibility.

|

M-bags (Airmail, IPA Service, and ISAL Service)

|

All M-bags.

|

$400 or less

|

2976

|

A fully completed PS Form 2976 must be affixed to PS Tag 158, M-bag Addressee Tag.

|

Over $400

|

Prohibited

|

|

* Qualifying items must meet the physical characteristics in 241.235. For example, the following items do not meet this requirement and must bear PS Form 2976: 1) Priority Mail International Flat Rate Envelopes that are not uniformly thick; 2) First-Class Package International Service items; and 3) IPA and ISAL packages (small packets) containing only documents.

|

A “known mailer” may be exempt from the customs form requirement that would otherwise apply to letter-size or flat-size mailpieces as defined in 241.2, or to package-size mailpieces as defined in 251.2. A “known mailer” must meet one of the definitions in 123.622 and must meet the conditions in 123.623.

A “known mailer” must meet one of the following definitions:

- A federal, state, or local government agency whose mail is regarded as Official Mail.

- A contractor who sends out prepaid mail on behalf of a military service, provided the mail is endorsed “Contents for Official Use — Exempt from Customs Requirements.”

- A business mailer who enters volume mailings through a business mail entry unit (BMEU) or other bulk mail acceptance location, completes a postage statement at the time of entry, pays postage through an advance deposit account, and uses a permit imprint for postage payment. For this purpose, the categories of mail that qualify are as follows:

- Priority Mail International Flat Rate Envelopes, except for contents allowed under 123.623b.

- First-Class Mail International service.

- International Priority Airmail (IPA) service.

- International Surface Air Lift (ISAL) service.

The following conditions apply to “known mailers”:

- The mailpieces must contain no merchandise or goods, except as provided in 123.623b and 123.623c.

- The mailpieces may contain hard copy printed or recorded media (e.g., CDs, DVDs, flash drives, video and cassette tapes), for which no customs form is required in the destination country. Authorization to mail items under this subsection without a customs form is subject to the following conditions:

- The mailpiece must not require an export license as described in 510, 520, 530, or 540.

- Any packaging used for package-sized items under this subsection must be transparent, such as shrinkwrap or polywrap material, so that the contents are fully visible for inspection.

- The mailpieces may contain goods of nominal value (less than $1.00) in conjunction with communications or informational materials for which no customs form is required in the destination country. In addition, authorization to mail items under this standard is subject to the following conditions:

- The mailpieces must not require an export license as described in 510, 520, 530, or 540.

- The mailpieces must not contain dangerous or prohibited items under IMM 135 or 136, or be otherwise prohibited by the destination country.

- The mailpieces cannot be destined to an E:1 country listed in 15 CFR 740, Supp. 2.

- The mailpieces cannot contain any items listed in the Commerce Control List (15 CFR 774) or the U.S. Munitions List (22 CFR 121).

- If the mailpieces are mailed with a postage statement, the mailer must certify on the postage statement that the mailpieces contain no dangerous materials that are prohibited by postal regulations.

- The import regulations of the destination country must allow individual mailpieces without a customs form affixed.

- For IPA and ISAL mailings, the mailer must pay with a permit imprint or with a combination postage method (meter postage affixed to the piece and additional postage by permit imprint). IPA and ISAL mailpieces that are paid for by postage solely with a meter do not qualify for the “known mailer” exemption.

- Failure to comply with the conditions in this section, or with any other applicable regulations or policies of the Postal Service or other relevant governmental authorities, may result in the suspension or revocation of eligibility to mail items without a customs form affixed pursuant to this section. For example, a suspension or revocation may result when the mailer fails to ensure his or her compliance with 510, 520, 530, or 540, such as ensuring that no mailings are sent to persons blocked from transacting in such items by the federal agencies described in those IMM sections.

In Exhibit 123.61, the “Type of Item” column has several references to “documents.” For this purpose, “documents” refers only to printed documents, not to electronic storage media or devices such as CDs, DVDs, or flash drives. Examples of documents include the following:

- Audit and business records.

- Personal correspondence.

- Circulars.

- Pamphlets.

- Advertisements.

- Written instruments not intended to be resold.

- Money orders, checks, and similar items that cannot be negotiated or converted into cash without forgery.

Examples of items that do not qualify as documents — rather, they are considered merchandise, so the sender is required to apply a customs declaration form and declare a value — include the following:

- CDs, DVDs, flash drives, video and cassette tapes, and other electronic storage media — regardless if they are blank or if they contain electronic documents or other prerecorded media.

- Artwork.

- Collector or antique document items.

- Books.

- Periodicals.

- Printed music.

- Printed educational or test material.

- Player piano rolls.

- Engineering drawings.

- Blueprints.

- Film.

- Negatives.

- X-rays.

- Separation negatives.

- Photographs.

When the chief postal inspector determines that a unique, credible threat exists, the Postal Service may require a mailer to provide photo identification at the time of mailing. The signature on the identification must match the signature on the customs declaration form.

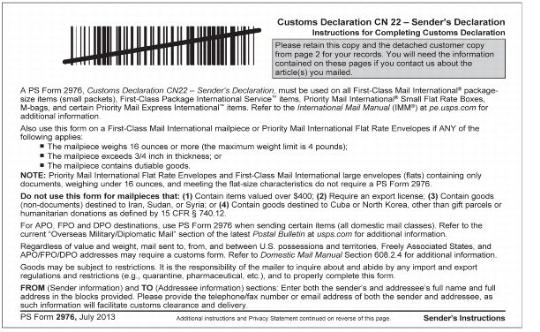

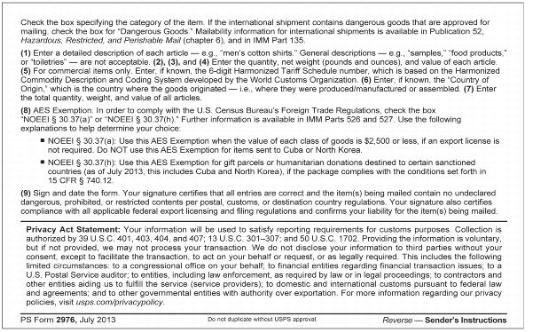

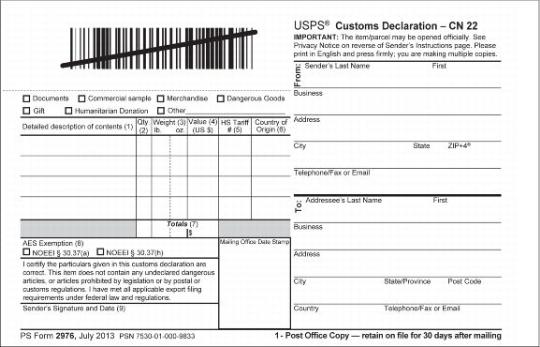

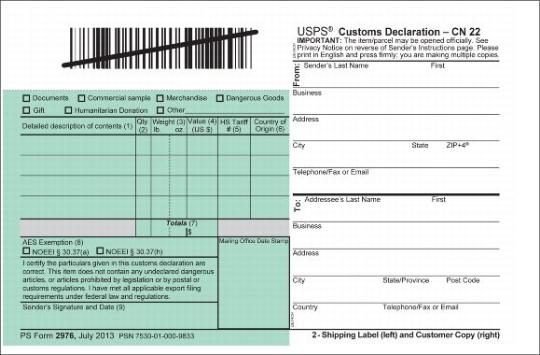

A sender must complete PS Form 2976, Customs Declaration CN 22 — Sender’s Declaration. See Exhibit 123.711a and Exhibit 123.711b for images of PS Form 2976.

- Check all applicable boxes to indicate whether the package contains a gift, documents, commercial samples, or other items. Check the box for “Dangerous Goods” if the shipment contains dangerous goods that are approved for mailing.

- In block (1), provide a detailed description, in English, of each article and the quantity for each article. General descriptions such as “food,” “medicine,” “gifts,” or “clothing” are not acceptable. In addition to the English text, a translation in another language is permitted.

- In block (2), enter the quantity of each article.

- In block (3), enter the weight of each article in pounds and ounces.

- In block (4), declare the value of each article in U.S. dollars.

Note: The sender may declare that the contents have no value. However, declaring that the contents have no value does not exempt an item from customs examination or charges in the destination country.

- The sender must enter the actual value of an item for registered items in a consistent manner on PS Forms 3806 and 2976 — i.e., the value entered must be identical. Items on which identical values are not declared will be refused. (See 334.12.)

- In block (5) — which is only for commercial items (i.e., any goods exported/imported in the course of a business transaction whether or not they are sold for money or exchanged) — enter, if known, the 6–digit Harmonized Tariff Schedule number, which is based on the Harmonized Commodity Description and Coding System developed by the World Customs Organization.

- In block (6), enter, if known, the “Country of Origin,” which is the country where the goods originated — i.e., where they were produced/manufactured or assembled.

- In block (7), enter the total quantity, weight, and value of all articles.

- In block (8), check “NOEEI § 30.37(a)” or “NOEEI § 30.37(h),” depending on the applicable Automated Export System (AES) Exemption.

- In block (9), sign and date in the blocks indicated on the left side and the right side of the form. The sender’s signature certifies that all entries are correct and the item(s) being mailed contain no undeclared dangerous, prohibited, or restricted contents per postal, customs, or destination country regulations. The sender’s signature also certifies compliance with all applicable federal export licensing and filing regulations and confirms the sender’s liability for the item(s) being mailed.

- Affix the form to the address side of the item and present the item for mailing.

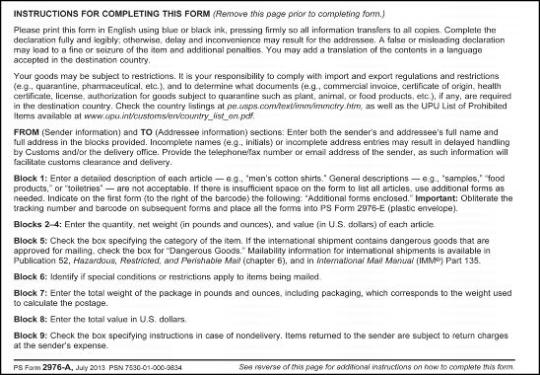

Exhibit 123.711a

PS Form 2976, Customs Declaration CN 22 — Sender’s Declaration

(Sender’s Instructions — Front and Reverse)

Note: PS Form 2976 is also available at the link below:

http://about.usps.com/forms/ps2976.pdf

\\ \\

Exhibit 123.711b

PS Form 2976, Customs Declaration CN 22 — Sender’s Declaration

(Copy 1 and Copy 2)

The Postal Service acceptance employee must do the following when accepting PS Form 2976 from the sender:

- Instruct the sender how to complete, legibly and accurately, PS Form 2976, as required. The sender’s failure to complete the form properly can delay delivery of the item or inconvenience the sender and addressee. Moreover, a false, misleading, or incomplete declaration can result in the seizure or return of the item and/or in criminal or civil penalties. The Postal Service assumes no responsibility for the accuracy of information that the sender enters on PS Form 2976.

- Verify that the sender has entered the information on the form, and has signed and dated the form in the spaces provided on the left side and the right side of the form. The sender’s address on the mailpiece must match the sender’s address on PS Form 2976.

- Enter the total weight of the package on the form, if the sender has not already done so.

- Round stamp the left side of Copy 1 (the Post Office copy) and the left side of Copy 2 (the shipping label). Tell the sender that the Postal Service will retain Copy 1 for 30 days as a record of mailing.

- To comply with U.S. Census Bureau requirements, it is the customer’s responsibility to ensure that an appropriate AES Exemption is selected or displayed on PS Form 2976. In addition, items sent to Cuba may require an Internal Transaction Number or AES Downtime Citation.

- A customer desiring evidence that the mailing has been presented to the Postal Service may purchase a certificate of mailing (see 310).

Note: Consistent with IMM 225.12, 235.12, 245.12, and 255.12, the customer must present any item bearing a handwritten PS Form 2976 to an employee at a Post Office retail service counter.

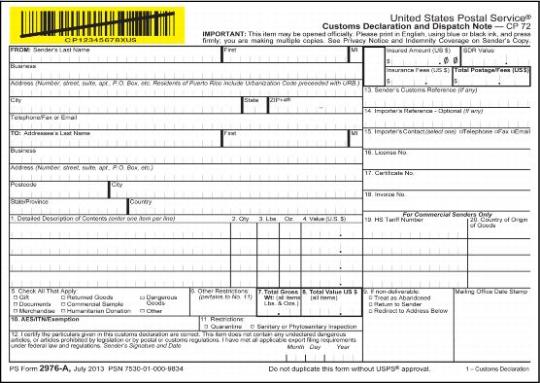

123.72 PS Form 2976–A, Customs Declaration and Dispatch Note — CP 72

See Exhibit 123.711a, b, and c for images of PS Form 2976-A.

- Enter both the sender’s and addressee’s full name and full address in the blocks provided. Provide the sender’s telephone/fax number or email address.

- In block (1), provide a detailed description, in English, of each article. General descriptions such as “food,” “medicine,” “gifts,” or “clothing” are not acceptable. In addition to the English text, a translation in another language is permitted. If there is insufficient space on the form to list all contents, use a second form (and subsequent forms, if necessary) to continue listing the contents, and indicate on the first form that the contents are continued on a subsequent form(s). When using this option, customers must ensure that the barcodes on the subsequent forms are totally obliterated to avoid multiple barcodes being assigned to the package. Place the form(s) into PS Form 2976-E (plastic envelope).

- In blocks (2), (3), and (4), enter the quantity, net weight (in pounds and ounces), and value (in U.S. dollars) of each article.

- In block (5), check all applicable boxes to indicate whether the package contains a gift, documents, commercial samples, or other items. Check the box for “Dangerous Goods” if the shipment contains dangerous goods that are approved for mailing.

- In block (6), note any restrictions that pertain to block 11.

- In block (7), enter the total gross weight in pounds and ounces.

- In block (8), enter the total value of all items in U.S. dollars.

- In block (9), provide disposal instructions in the event that the package cannot be delivered. Check the appropriate box to indicate whether the package is to be returned, treated as abandoned, or forwarded to an alternate address. Undeliverable packages returned to the sender are, upon delivery, subject to collection of return postage and any other charges assessed by the foreign postal authorities. If you are unwilling to pay return postage, check the box “Treat as Abandoned.”

- In block (10), enter the applicable Automated Export System (AES) Internal Transaction Number (ITN) or AES Exemption.

- In block (11), provide details if the contents are subject to quarantine (plant, food products, etc.).

- In block (12), sign and date the form. The sender’s signature certifies that all entries are correct and that the item contains no undeclared dangerous, prohibited, or restricted contents per postal, customs, or destination country regulations.

- In blocks (13) and (14), enter the applicable number if the item requires a sender’s customs reference or importer’s reference.

- In block (15), enter, if known, the importer’s telephone number, fax number, or email address.

- In blocks (16), (17), and (18), enter license, certificate, and/or invoice number, if applicable.

- In block (19), enter, if known, the 6-digit Harmonized Tariff Schedule number, which is based on the Harmonized Commodity Description and Coding System developed by the World Customs Organization.

- In block (20), enter the “Country of Origin,” which is the country where the goods originated — i.e., where they were produced/manufactured or assembled.

- Insert the completed form(s) into PS Form 2976-E (plastic envelope) and affix PS Form 2976-E to the address side of the package. Allow the Postal Service employee to complete PS Form 2976-A as described in 123.722.

- Present the item for mailing.

Exhibit 123.721a

PS Form 2976-A, Customs Declaration and Dispatch Note — CP 72

(Instructions)

Note: To see the complete PS Form 2976-A, click the link below:

http://about.usps.com/forms/ps2976a.pdf

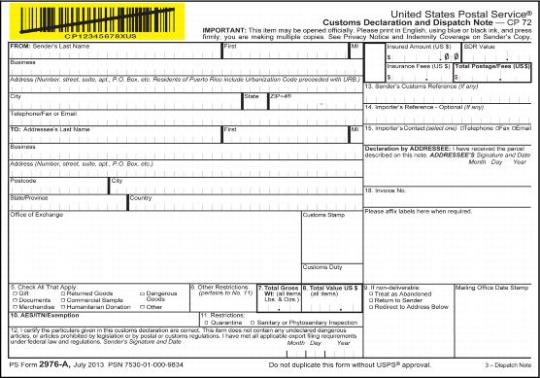

Exhibit 123.721b

PS Form 2976-A, Customs Declaration and Dispatch Note — CP 72

(Copies 1 and 3)

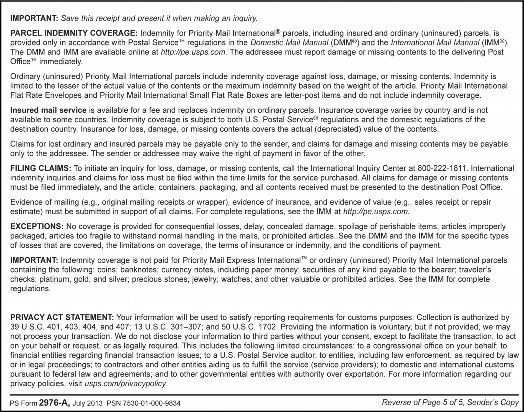

Exhibit 123.721 c

PS Form 2976-A, Customs Declaration and Dispatch Note — CP 72

(Indemnity Statement)

The Postal Service acceptance employee must do the following when accepting PS Form 2976–A from the sender:

- Instruct the sender how to complete, legibly and accurately, PS Form 2976–A, as required. The sender’s failure to complete the form properly can delay delivery of the item or inconvenience the sender and addressee. Moreover, a false, misleading, or incomplete declaration can result in the seizure or return of the item and/or in criminal or civil penalties. The Postal Service assumes no responsibility for the accuracy of information that the sender enters on PS Form 2976–A.

- Verify that the sender has entered the information on the form and has signed and dated the declaration. The sender’s address on the mailpiece must match the sender’s address on PS Form 2976–A.

- To comply with U.S. Census Bureau requirements, it is the customer’s responsibility to ensure that an appropriate AES ITN, AES Exemption, or AES Downtime Citation is displayed on PS Form 2976-A. If this information is not entered, remind the customer that he or she may be subject to civil and criminal penalties for noncompliance.

- If the sender wishes to insure the contents, the retail associate will record the insured amount in U.S. dollars and special drawing right (SDR) value on PS Form 2976-A in the space provided. (See Exhibit 323.62 for the conversion table.)

- Weigh the parcel, enter the weight in block (8), and enter the applicable amount of postage and fees in the appropriate block in the upper right corner of the form.

- Round stamp the form in the appropriate place on each copy (copies 1–6).

- Remove the Post Office copy (Copy 4) and tell the mailer that the Postal Service will retain this document for 30 days as a record of mailing. Remove the Sender copy (Copy 5) and give it to the mailer.

- Round stamp any uncanceled stamps, and if postage is paid by meter, round stamp the front of the piece near the meter postage.

Note: Consistent with IMM 225.12, 235.12, 245.12, and 255.12, the customer must present any item bearing a handwritten PS Form 2976-A to an employee at a Post Office retail service counter.

123.73 PS Form 2976–E, Customs Declaration Envelope — CP 91

PS Form 2976-E is a transparent plastic envelope designed to carry and protect the PS Form 2976-A and PS Form 2976-B customs form sets. After completing the forms, the mailer inserts the PS Form 2976-A or PS Form 2976-B form set into the envelope of PS Form 2976-E, removes the backing sheet, and affixes it to the package on the address side. The current edition of PS Form 2976-E is July 2013; however, the mailer may use older editions.

|